Continued growth with revenue at high end of guidance and Adjusted EBITDA exceeding guidance New amended financing agreement provides long-term flexible capital to execute the business plan.

Burlington, Mass., May 06, 2019 - Avid® (NASDAQ: AVID), a leading technology provider that powers the media and entertainment industry, announced its first quarter 2019 financial results, provided guidance for the second quarter of 2019 and reaffirmed full-year 2019 guidance.

First Quarter 2019 Financial and Business Highlights

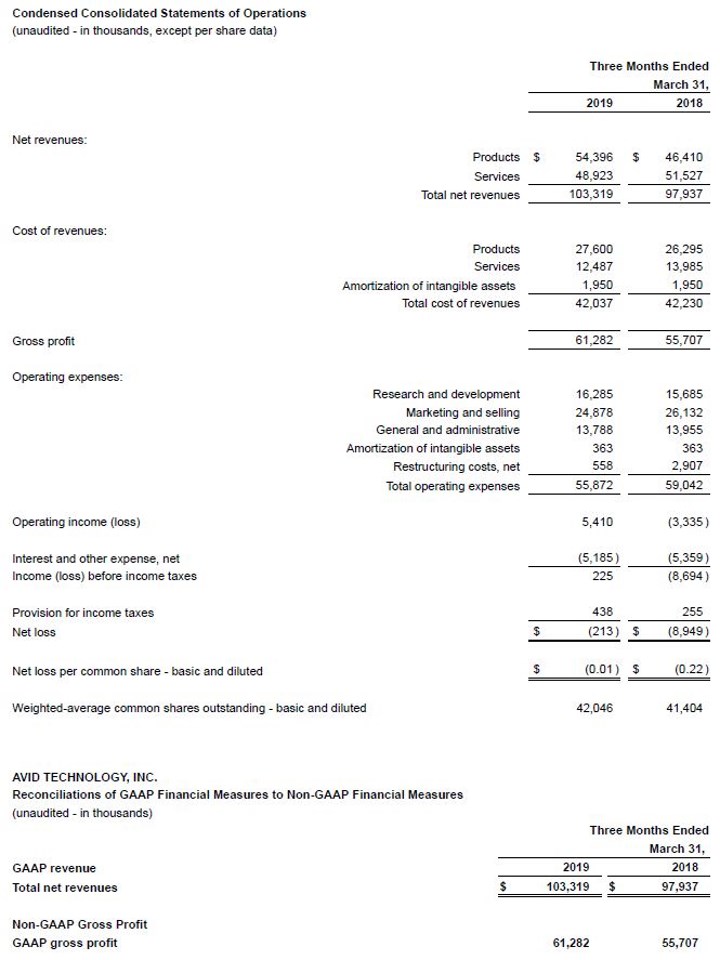

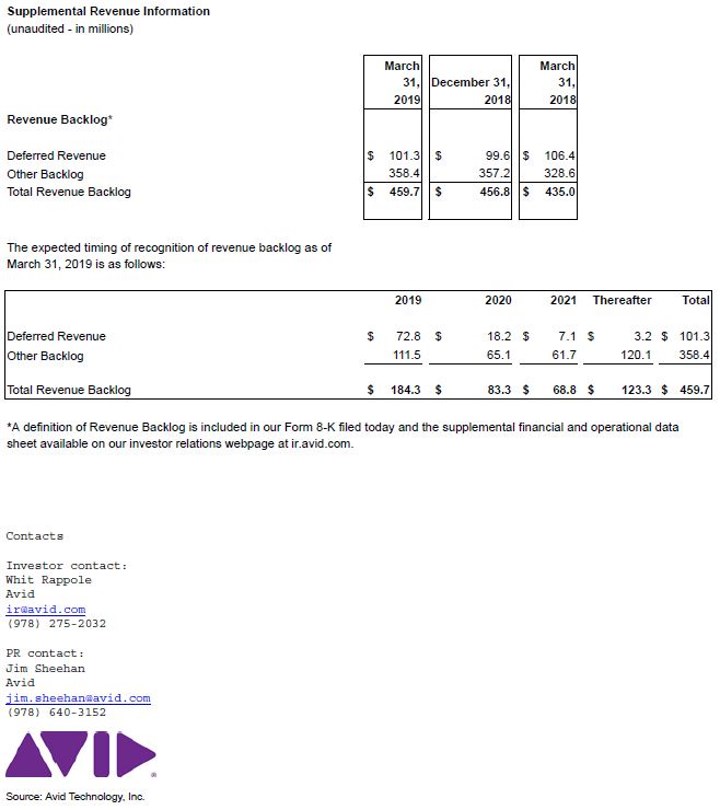

• Revenue was $103.3 million, the second consecutive quarter of 5% year-over-year growth.

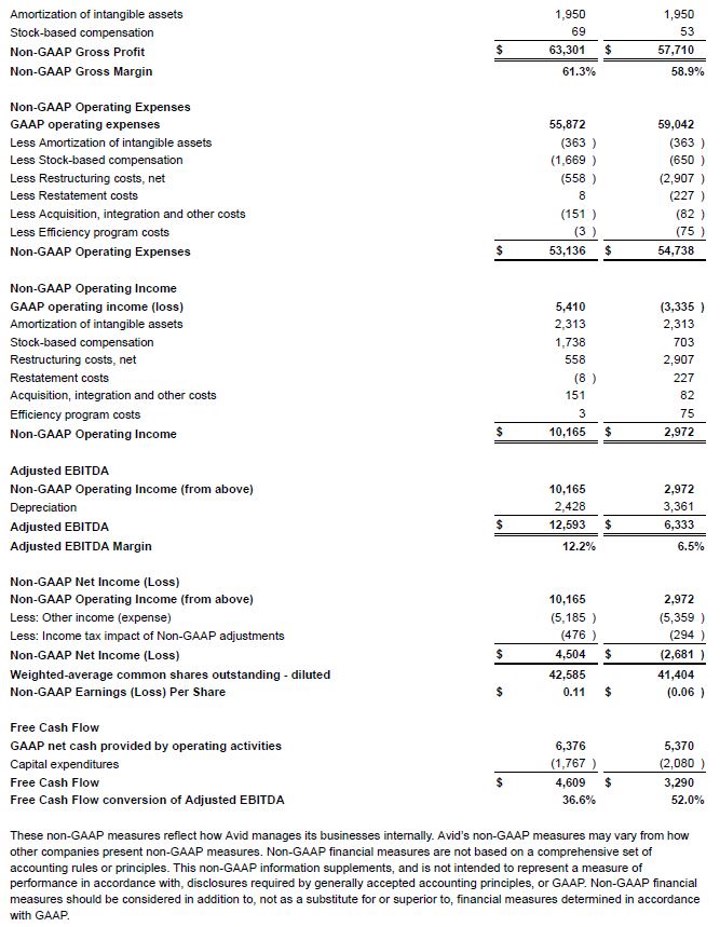

• Gross margin was 59.3%, up 240 basis points year-over-year. Non-GAAP Gross Margin was 61.3%, up 240 basis points year-over-year.

• Operating expenses were $55.9 million, a decrease of 5% year-over-year. Non-GAAP Operating Expenses were $53.1 million, a decrease of 3% year over year.

• Operating income was $5.4 million, up from operating loss of ($3.3) million in Q1 2018. Non-GAAP Operating Income was $10.2 million, an increase of $7.2 million year-over-year.

• Adjusted EBITDA was $12.6 million, an increase of 99% year-over-year. Adjusted EBITDA Margin was 12.2%, up 570 basis points year-over-year.

• GAAP net loss per common share was ($0.01), up from net loss per common share of ($0.22) in Q1 2018. Non-GAAP Earnings per Share was $0.11, up from Non-GAAP Loss per Share of ($0.06) in Q1 2018.

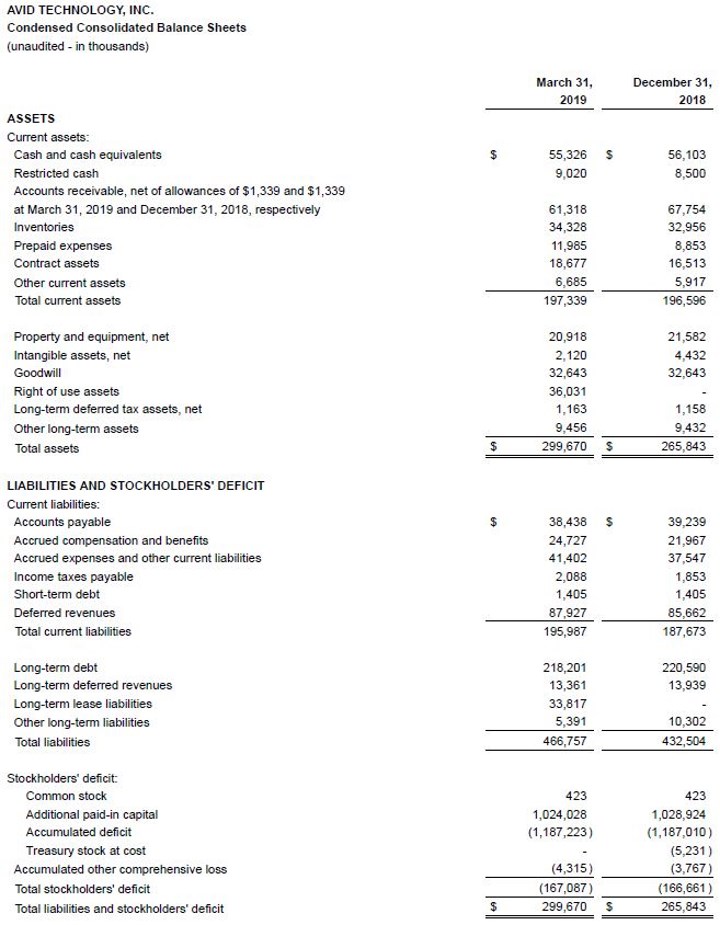

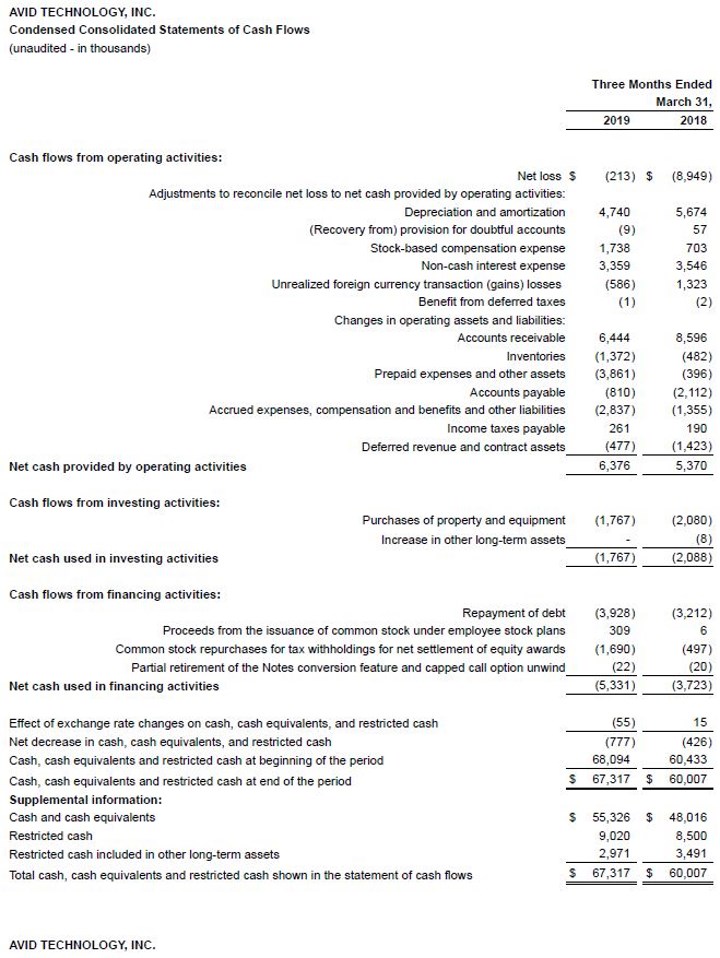

• Net cash provided by operating activities was $6.4 million, up from $5.4 million in Q1 2018.

• Free Cash Flow was $4.6 million, up from $3.3 million in Q1 2018.

• Software revenue from subscriptions increased 10% year-over-year with approximately 137,000 cloud-enabled software subscriptions at the end of Q1 2019.

• Revenue through the Company's e-commerce activities was up 33% year-over-year.

• Recurring Revenue was 57% of the Company's revenue in the twelve months ending March 2019, up from 50% in the twelve months ending March 2018.

• Annual Contract Value was $237 million at the end of Q1 2019, up from $222 million at the end of Q1 2018.

“We are pleased that the momentum Avid generated at the end of last year has continued throughout the first quarter of this year, underscoring our continued success in executing our strategy,” said Jeff Rosica, CEO and President of Avid. He continued, “We are focused on delivering meaningful product innovations to the market, including several new products in Q2, that we expect will support our growth in the second half of 2019 and beyond. We expect this renewed growth combined with greater discipline in our operations will drive increased profitability and deliver greater shareholder value.”

“We started 2019 with strong momentum, as evidenced by our improving revenue, gross margin and Adjusted EBITDA,” commented Ken Gayron, Executive Vice President and Chief Financial Officer of Avid. Mr. Gayron added, “As a result of the improvement in our financial performance, we have secured $100 million in additional bank debt at a reduced interest rate and more favorable terms to support our business strategy. Since the proceeds will be used to repurchase our outstanding convertible notes, there will be an immaterial change in the total debt for the Company once the transactions are completed.”

With respect to the financing agreement, on April 8, 2019, the Company signed an amendment to its existing financing agreement adding a new $100 million term loan to be used to repurchase outstanding 2.00% convertible notes due June 2020 (the “Convertible Notes”). The amended agreement provides flexible capital through May 2023 at a reduced interest rate of LIBOR +6.25%. On April 11,2019, the Company launched a tender offer for the Convertible Notes which is anticipated to expire on May 9, 2019.

Explanations regarding our use of non-GAAP financial measures and operational metrics and related definitions, and reconciliations of our GAAP and non-GAAP measures, are provided in the sections below entitled "Non-GAAP Financial Measures and Operational Metrics" and "Reconciliations of GAAP Financial Measures to Non-GAAP Financial Measures".

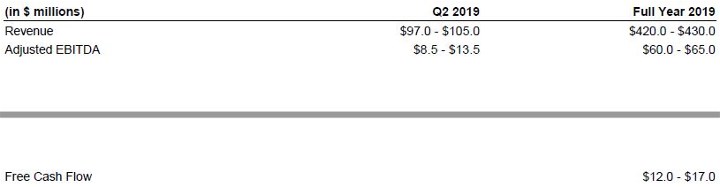

Second Quarter and Full Year 2019 Guidance

For the second quarter of 2019, Avid is providing Revenue and Adjusted EBITDA guidance. Avid is also reaffirming its guidance for Revenue,

Adjusted EBITDA and Free Cash Flow for full-year 2019.

All guidance presented by the Company is inherently uncertain and subject to numerous risks and uncertainties. Avid's actual future results of operations could differ materially from those shown in the table above. For a discussion of some of the key assumptions underlying the guidance, as well as the key risks and uncertainties associated with these forward-looking statements, please see “Forward-Looking Statements” below as well as the Avid Technology Q1 2019 Business Update presentation posted on Avid's Investor Relations website.

Conference Call

Avid will host a conference call to discuss its financial results for the first quarter on Monday, May 6, 2019 at 5:00 p.m. ET. The call will be open to the public and can be accessed by dialing 323-994-2093 and referencing confirmation code 9113081. You may also listen to the call on the Avid Investor Relations website. To listen via the website, go to the events tab at ir.avid.com for complete details prior to the start of the conference call. A replay of the call will also be available for a limited time on the Avid Investor Relations website shortly after the completion of the call.

Non-GAAP Financial Measures and Operational Metrics

Avid includes non-GAAP financial measures in this press release, including Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Non-GAAP Gross Profit, Non-GAAP Gross Margin, Non-GAAP Operating Expenses, Non-GAAP Operating Income, Non-GAAP Net Income (Loss) and Non-GAAP Earnings (Loss) per Share. The Company also includes the operational metrics of Bookings, Cloud-enabled software subscriptions, Recurring Revenue and Annual Contract Value in this release. Avid believes the non-GAAP financial measures and operational metrics provided in this release provide helpful information to investors with respect to evaluating the Company's performance. Unless noted, all financial and operating information is reported based on actual exchange rates. Definitions of the non-GAAP financial measures and operational metrics are included in our Form 8-K filed today. Reconciliations of the non-GAAP financial measures in this release to the Company's comparable GAAP financial measures for the periods presented are set forth below and are also included in the supplemental financial and operational data sheet available on our investor relations webpage at ir.avid.com, which also includes definitions of all operational metrics.

The earnings release also includes forward-looking non-GAAP financial measures, including Adjusted EBITDA and Free Cash Flow. Reconciliations of these forward-looking non-GAAP financial measures are not included in the earnings release due to the high variability and difficulty in making accurate forecasts and projections of some of the excluded information, together with some of the excluded information not being ascertainable or accessible at this time. As a result, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measure without unreasonable efforts.

Forward-Looking Statements

Certain information provided in this press release, including the tables attached hereto, include forward-looking statements that involve risks and uncertainties, including projections and statements about our anticipated plans, objectives, expectations and intentions. Among other things, this press release includes estimated results of operations for the three months ending June 30, 2019 and the year ending December 31,2019, which estimates are based on a variety of assumptions about key factors and metrics that will determine our future results of operations, including, for example, anticipated market uptake of new products and market-based cost inflation. Other forward-looking statements include, without limitation, statements based upon or otherwise incorporating judgments or estimates relating to future performance such as future operating results and expenses; earnings; backlog; revenue backlog conversion rate; product mix and free cash flow; Recurring Revenue and Annual Contract Value; our future strategy and business plans; our product plans, including products under development, such as cloud and subscription based offerings; our ability to raise capital and our liquidity. The projected future results of operations, and the other forward-looking statements in this release, are based on current expectations as of the date of this release and subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including but not limited to the effect on our sales, operations and financial performance resulting from: our liquidity; our ability to execute our strategic plan, and meet customer needs; our ability to retain and hire key personnel; our ability to produce innovative products in response to changing market demand, particularly in the media industry; our ability to successfully accomplish our product development plans; competitive factors; history of losses; fluctuations in our revenue based on, among other things, our performance and risks in particular geographies or markets; our higher indebtedness and ability to service it and meet the obligations thereunder; restrictions in our credit facilities; our move to a subscription model and related effect on our revenues and ability to predict future revenues; fluctuations in subscription and maintenance renewal rates; elongated sales cycles; fluctuations in foreign currency exchange rates; seasonal factors; adverse changes in economic conditions; variances in our revenue backlog and the realization thereof; and the possibility of legal proceedings adverse to our company. Moreover, the business may be adversely affected by future legislative, regulatory or other changes, including tax law changes, as well as other economic, business and/or competitive factors. The risks included above are not exhaustive. Other factors that could adversely affect our business and prospects are set forth in our public filings with the SEC. Forward-looking statements contained herein are made only as to the date of this press release and we undertake no obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

About Avid

Avid delivers the most open and efficient media platform, connecting content creation with collaboration, asset protection, distribution, and consumption. Avid's preeminent customer community uses Avid's comprehensive tools and workflow solutions to create, distribute and monetize the most watched, loved and listened to media in the world—from prestigious and award-winning feature films to popular television shows, news programs and televised sporting events, and celebrated music recordings and live concerts. With the most flexible deployment and pricing options, Avid's industry-leading solutions include Media Composer®, Pro Tools®, Avid NEXIS®, MediaCentral®, iNEWS®, AirSpeed®, Sibelius®, Avid VENUE™, Avid FastServe®™, Maestro™, and PlayMaker™. For more information about Avid solutions and services, vwww.avid.com, connect with Avid on Facebook, Instagram, Twitter, YouTube, LinkedIn, or subscribe to Avid Blogs.

© 2019 Avid Technology, Inc. All rights reserved. Avid, the Avid logo, Avid NEXIS, Avid FastServe, AirSpeed, iNews, Maestro, MediaCentral, Media Composer, NewsCutter, PlayMaker, Pro Tools, Avid VENUE, and Sibelius are trademarks or registered trademarks of Avid Technology, Inc. or its subsidiaries in the United States and/or other countries. All other trademarks are the property of their respective owners. Product features, specifications, system requirements and availability are subject to change without notice.

Info: www.avid.com

Notes: Announcement - AVID - Burlington, Mass., May 06, 2019